401k to roth 401k conversion calculator

Amount to convert Amount to convert from a Pre-tax 401 k account to a Roth 401 k. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Roth Ira Conversion Ameriprise Financial

With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k.

. 1 current versus future tax rates 2 avoiding the taxable required minimum. First enter the current balance. 10 Best Lenders to Rollover Your 401K into Gold IRA.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. A Roth conversion is an optional decision to change part or all of an existing tax-deferred retirement plan such as a 401 or a traditional IRA to a Roth IRA. This is because the IRS requires retirement savers to pay taxes on employer contributions.

New Look At Your Financial Strategy. A conversion has both advantages and disadvantages that should be carefully considered before you make a decision. This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement.

Roth IRA Conversion Calculator Is converting to a Roth IRA the right move for you. Many roth ira conversion calculator for excel articles discuss the interplay between three variables. Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool.

Ad Open an IRA Explore Roth vs. Ad Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Because you pay the conversion tax in advance you also eliminate the income tax your current heirs would in any other case have to pay out on withdrawals.

Visit The Official Edward Jones Site. A backdoor Roth 401 k conversion is the transfer of both the pretax and after-tax contributions in a regular 401 k account to an employer-designated Roth 401 k account. 2022 Roth Conversion Calculator.

Traditional vs Roth Calculator Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. As of January 2006 there is a new type of 401 k -- the Roth 401 k. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

This calculator compares two alternatives with equal out of pocket costs. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Traditional 401 k and your Paycheck A 401 k can be an effective retirement tool.

Make a Thoughtful Decision For Your Retirement. Discover How Much to Convert 2022 Roth Conversion Calculator This calculator can help you make informed decisions about performing a Roth. This calculator will show the advantage if any of converting your pre-tax 401k to a Roth 401k.

Strong Retirement Benefits Help You Attract Retain Talent. So Roth conversions give you tax free withdrawals and growth with fewer rules. Traditional or Rollover Your 401k Today.

Protect Yourself From Inflation. As of January 2006 there is a. Roth 401 k vs Traditional 401 k Calculator Updated May 2022 Roth vs.

This calculator compares two alternatives with equal out of pocket costs. Traditional or Rollover Your 401k Today. Roth 401 k Conversion Calculator.

With the passage of the American Tax Relief Act any 401k plan that allows for Roth. Ad Open an IRA Explore Roth vs. The Difference Between a Roth 401 k and Traditional 401 k Contributions with post-tax dollars versus pre-tax dollars.

Ad Roll Over Existing IRA Accounts and Manage Your Fidelity Account Today. Roth IRA Conversion Calculator Use this Roth IRA conversion calculator to project the inflation-adjusted after-tax value of your Traditional IRA or 401k at retirement versus the inflation. Your Goals Deserve A Strong Foundation Prudential Is Here To Assist You Today Everyday.

This calculator compares two alternatives with equal out of pocket. However matching contributions to a Roth 401 k must be placed in a separate pre-tax 401 k. A conversion has both advantages and disadvantages that should be carefully considered before you make a decision.

Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. Expected Federal Income Tax Rate at RetirementBased on your income at retirement the amount of federal income taxes you expect to pay at retirement as compared to your current federal. With a Traditional 401 k the money you contribute is.

Make a Thoughtful Decision For Your Retirement. A conversion has both advantages and disadvantages that should be carefully considered before you make a decision. Reasons to Do a Roth Conversion Right Now.

This calculator can help you decide if converting money from a non-Roth IRA s including a traditional. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Explore The Advantages of Moving an IRA to Fidelity.

We assume that you are paying any taxes owed with funds that you have available outside of the. However you pay for these benefits upfront.

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Infographic Converting To A Roth 401k Llc Solo 401k

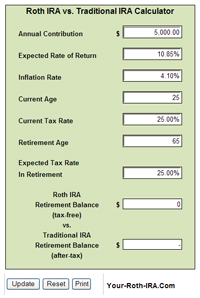

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Ultimate Roth 401 K Guide District Capital Management

How To Access Retirement Funds Early

How To Access Retirement Funds Early

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators

Traditional Vs Roth Ira Calculator

Traditional Vs Roth Ira Calculator

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Conversion Calculator Solo 401k

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401 K Vs Roth 401 K Calculator Which One Should You Invest In The Kickass Entrepreneur

How To File Irs Form 1099 R Solo 401k